As a leading provider of accountancy staff, we look at what does accountancy mean, it’s history and importance to businesses today. Plus we explore the huge variety of careers available in the accountancy profession, and why accountancy really is a great career choice! We’ve included some great, useful links at the end too!

First, ‘WHAT IS ACCOUNTANCY?’

Historically, ‘Financial Accounting’ referenced how information was communicated on the financial position and performance of a business to its owner(s). An instant snapshot of how a business is really performing.

Financial statements, i.e. balance sheets and the income statement of a business revealed the real financial health of a company.

The word ‘accounting’, however, referred to one of the three principles of accountancy namely the process of reading, understanding, and maintaining the financial records of a business.

The other two? – Bookkeeping and auditing.

Accountancy and accounting are now synonymous, both referring to the methods of identifying, measuring, processing, classifying, recording, and reporting the financial status of an individual, company, business or organisation.

This information is mainly reported in the form of five key financial statements, prepared in accordance with relevant accounting standards, (IFRS, FRS, and various national GAAPs – including US GAAP – i.e. ‘generally accepted accounting principals’) to provide useful information to the users of these financial statements.

The two most important and most used accounting standards are IFRS and US GAAP.

USEFUL LINK: https://www.cfainstitute.org/en/advocacy/issues/gaap

Accounting is one of the key functions of every business. Every company, charity, and organisation around the world will have the use of an accounting department, internally or externally, to look after it’s transactions, i.e. sales ledger and purchase ledger.

The size of the accounting department of a business depends on the scale and type of business. In larger companies, the accounting department usually has many more staff compared to SMEs.

Smaller SME companies and businesses typically have one or two bookkeepers/ accounts all-rounders, who can manage the day to day transactions, and either have an external accountant to refer to, monthly or yearly, or employ a company accountant/ financial controller or finance director/ Chief Operating Officer (CFO).

Similarly, businesses with a larger number of transactions per day will need more employees in their accounting department than ones with a smaller number of transactions.

Where did Accountancy come from?

Accountancy is one of the oldest professions, with a very rich past woven through history.

The modern guidelines we use today were formed from accounting principles started thousands of years ago in ancient region of Asia, called Mesopotamia.

When the idea of counting, tallying money and writing were conceived, that’s when the concept of accountancy is thought to have been born.

The Romans brought order and more formal processes in accounting. Logging and filing transactions.

Double-entry bookkeeping as we know it today, was credited as being first created in 1494 by Luca Pacioli, an Italian mathematician.

Pacioli is commonly credited as the first person to describe the concept of debits and credits in journals and ledgers.

Pacioli is commonly credited as the first person to describe the concept of debits and credits in journals and ledgers.

His work in the field of accounting earned him the title of “Father of accounting” and he laid the foundation of modern accounting systems and processes.

The industrial revolution in the mid to late 18th century, created the need for a more advanced system of accounting.

The old, ancient accounting systems, while intrinsically sound, did not provide a solution for the then emerging modern structures of corporations.

For example, corporations had complex structures of ownership that did not exist in ancient times. Investments in those businesses were hard to make due to the lack of credible, detailed information available to investors.

To tackle this problem and attract more investors, corporations adopted a system of reporting their financial activities by publishing financial statements.

At the beginning, these financial statements were limited to the balance sheet, income statement, and cash flow statement. The rise of the system of financial statements also gave rise to agency problems.

Agency problems arose because the shareholders of a corporation did not believe the management. This led to the development of a mainstream auditing system.

While the concept of auditing was already developed in ancient Egypt, it became a mainstream practice during these times.

So, what is an Accountant? What is their job?

An accountant is a professional practitioner of accountancy. Accountants are trained, competent professionals who have worked through different professional certification exams, or through their careers, have become ‘Qualified By Experience’.

Accountants are members or associates of professional accounting bodies such as the Association of Chartered Certified Accountants (ACCA), Institute of Chartered Accountants in England and Wales (ICAEW), Association Accounting Technicians (AAT).

- Useful links to all of the professional accountancy bodies are at the foot of this blog if you would like to find out more about their courses, the training and examinations these really good organisations can offer to aspiring accountants.

In ancient times, accountants were viewed as solicitors that offered accounting services to their clients. However, in the mid-19th century, the Institute of Accountants in Glasgow petitioned Queen Victoria no less, for a royal charter.

This permitted them to legally define themselves as ‘accountants’ in their own right, rather than as ‘solicitors’. Even before the petition, accountancy as a profession was already recognised in Scotland. The petition to Queen Victoria meant that accountants could for the first time, be seen as professionals in accountancy rather than mere solicitors in the rest of the world as well.

This petition also laid the foundation for many professional accounting bodies such as the London Association of Accountants, later renamed to Association of Chartered Certified Accounts (ACCA) in the United Kingdom and the Certified Public Accountants (CPA) in the United States.

Aided by the industrial revolution, this created a demand for technically sound professionals who were capable of handling modern accountancy problems.

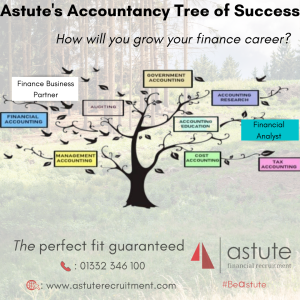

Branches of Accountancy – Our Astute ‘Accountancy Tree’ gives some clues!

Most people think of accountancy as simple bookkeeping and debits and credits. While these are a part of accountancy as a profession, there are several branches you can follow, each leading to varied, exciting and commercial accounting and finance jobs that are very different from each other.

Choosing Accountancy as a profession really can offer contrasting, fulfilling, and varied career choices.

We’ve broken down the key ones for you below: –

1) Financial Accounting

Financial accounting is the most popular and widely implemented branch of accountancy. Financial accounting branch is related to the reporting of the financial status of a business, through the financial statements, and any process that helps with the preparation of these financial statements.

For example, any process involved from entering source documents into the accounting systems of the business up to the preparation of the key financial statements falls under the financial accounting branch.

Careers can develop from training within a firm of accountants – local, regional firms including Dains, to the so called ‘Big 4’ – PWC, EY, Deloittes, and KPMG.

Or, you can choose commerce and industry (C&I), and secure Graduate Trainee Accountancy positions or Trainee Transactional jobs, such as Accounts Payable (AP), Accounts Receivable (AR) – also commonly referred to as Credit Control, and Accounts Assistant positions.

2) Management Accounting

While financial accounting has to do with the preparation of the information that is reported externally, management accounting is related to the preparation of information for internal use.

Daily or monthly operating reports, budgets, variance analysis, etc. all fall under management accounting.

The information produced through management accounting is used by the management of the business to make decisions for the future of the business. These can be used for short-term or long-term strategy making.

3) Cost Accounting

Cost accounting is similar to management accounting and often considered a type of management accounting.

Cost accounting is the area of accountancy that is commonly used in the manufacturing industry. Costings are used to derive the cost of a product for decision-making purposes.

This cost can be calculated using different costing techniques such as absorption costing, marginal cost, activity-based costing, target costing, etc. Once costs are determined, cost accounting is also concerned with monitoring those costs. Some companies typically have a dedicated Cost Accountant while others employ a Management Accountant whose job description will also embrace Costings.

4) Auditing

While auditing does not involve preparing any accounting information, it is related to reviewing the information produced through other branches of accounting.

Auditing can either be internal or external. Internal auditing is performed by the management of the business to review accounting information produced for internal use.

External accounting is related to reviewing the information produced for external use, which mainly includes reviewing the financial statements of a business.

Auditing can also be used to determine level of internal control of an organization.

Just as with Financial Accounting, careers can develop from training within a firm of accountants – local, regional firms including Dains, to the so called ‘Big 4’ – PWC, EY, Deloittes & KPMG.

Each will have their own trainee schemes and will look to recruit staff directly through LinkedIn or use the services of an accountancy recruitment agency or recruitment consultancy.

5) Forensic Accounting

Forensic accounting is closely related to auditing. Forensic accounting is related to the use of accountancy techniques, skills, and knowledge in circumstances that might have legal implications.

Forensic accounting is the process of carrying out forensic investigations to present in a legal proceeding. Forensic accounting is mainly used for fraud investigations within the business, professional negligence cases, or insurance claims.

6) Accounting Information System – or System Accountants

Accounting Information System (AIS) is related to the collection, development, deployment, implementation and monitoring of the accounting procedures and systems that are used in the accounting process.

With the computerisation of the accounting process, AIS has become a computerized methodology for conducting accounting processes with information technology resources.

7) Tax Accounting

Tax accounting is the branch of accountancy that deals with the application of tax planning to benefit the business and preparation of tax returns.

It also involves calculating the income tax and other taxes of the business. Tax accounting is used to legally decrease the taxes of the business. Tax accounting should not be used for tax evasion.

The rules of tax accounting are defined and dictated by the local tax body of the country the tax is being paid in.

8) Fiduciary Accounting

Fiduciary accounting is the branch of accountancy that is related to the management of funds in trusts. This branch is mainly concerned with the trustee communicating any financial information about the trust to the beneficiaries.

Fiduciary accounting is regulated by the law and court and, therefore, the information produced through this branch must be accurate and precise.

9) Nonprofit Accounting

Nonprofit accounting mainly applies to charities and nonprofit organisations. In this branch of accountancy, incomes and expenses are recorded according to the nonprofit accounting standards. (SORPS)

This is the alternative of financial accounting for nonprofit organizations. In this branch of accounting, expenses are recorded in the statement of functional expenses.

Furthermore, both the income and expenses are recorded in the statement of activities.

10) Social Accounting

Social accounting is the branch of accountancy that is related to reporting the effect of the business’ activities on the society and environment.

For companies, social accounting is used in the context of Corporate Social Responsibility (CSR) and companies may be required by law to do so.

However, other types of organisations such as not-for-profits, charities or government departments, may also choose to adapt social accounting voluntarily.

So, in summary, ‘Accountancy’ or ‘accounting’ is the process of identifying, measuring, processing, classifying, recording, and reporting the financial information of a business.

Accountancy has many branches such as financial accounting, management accounts, financial analysis, cost accounting, auditing, tax accounting, and many, many more.

Modern popular careers in accountancy and finance that are increasingly key in today’s collaborative business world, are Finance Business Partners – blending the worlds of management accounting, financial analysis and stakeholder engagement.

If you are looking for a career in accountancy, or are wanting to develop your CPD / training – here are some useful links: –

USEFUL LINKS: –

CIMA – https://www.cimaglobal.com/

ACCA – https://www.accaglobal.com/uk/en.html

ICAEW (ACA) – https://www.icaew.com/

AAT – https://www.aat.org.uk/

FRC (Financial Reporting Council) – https://www.frc.org.uk/accountants/accounting-and-reporting-policy/uk-accounting-standards/statements-of-recommended-practice-(sorps)

If you are looking for training providers for the professional accountancy examinations you can contact these two great organisations: –

KAPLAN – https://kaplan.co.uk/

BPP – https://www.bpp.com/

You can view our latest permanent and temporary vacancies on the following link;

https://www.astuterecruitment.com/all-jobs/

If you would like any further help, guidance or support, please contact our MD, Mary Maguire by email to; [email protected]

Or of course you can contact our team on 01332 346 100 – we are always happy to help.

Mary Maguire

Managing Director

Astute | Accountancy & Finance | HR | Office Support

Suite One, Ground Floor West, Cardinal Square, 10 Nottingham Road, Derby, DE1 3QT

T: 01332 346100

M: 07717 412911

LI: https://uk.linkedin.com/pub/mary-maguire/18/73/553

LI: www.linkedin.com/company/astute-recruitment/