Feeling lonely at work? Key tips how you can prevent loneliness at work.

In line with the theme for this year’s Mental Health Week, we wanted to explore some key tips to show how businesses, employers and HR professionals can help to avoid loneliness in the office.

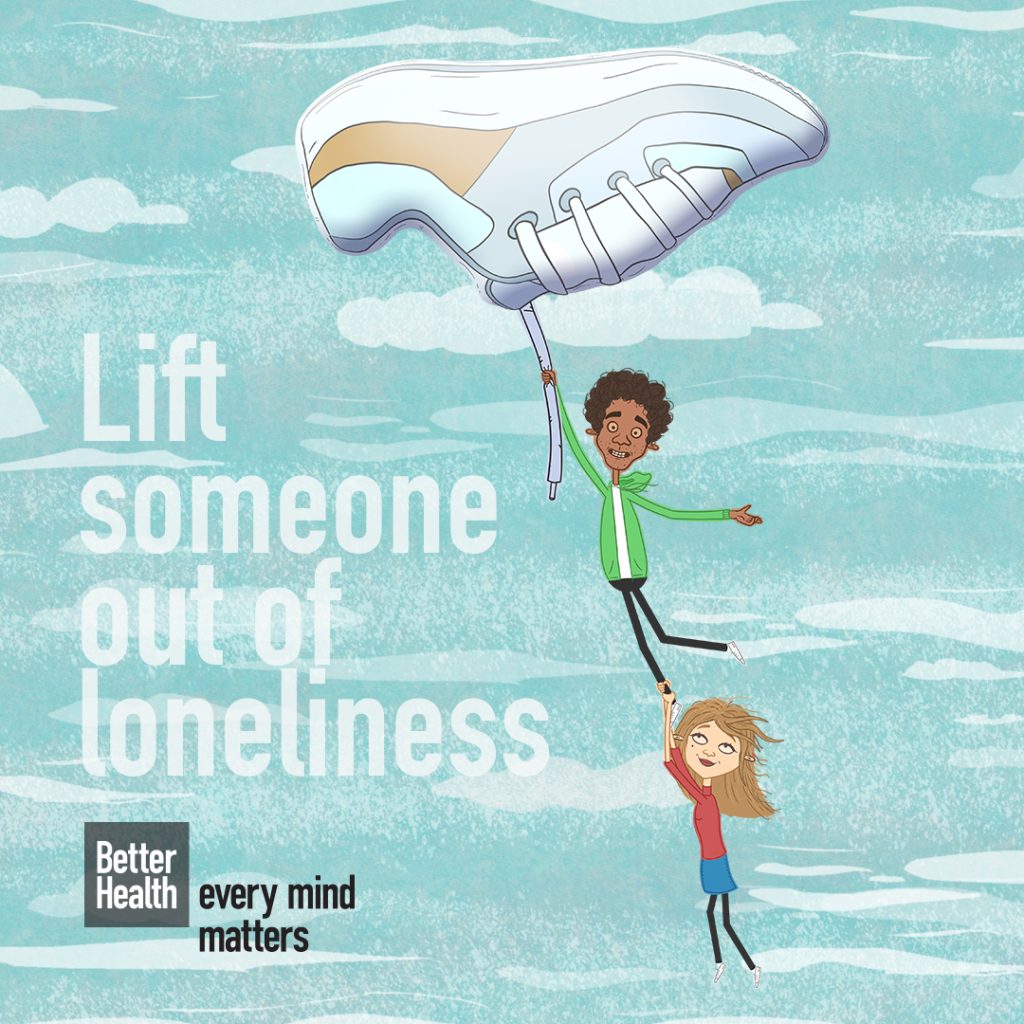

Loneliness can be crushing and can severely dent people’s sense of wellbeing and mental health. Nowhere can this be more evident than at work. Whether in an office or on the factory floor, so many core emotions can be stirred by loneliness from low-self-esteem to anxiety.

Feeling alone at work can also hugely impact businesses, employers and organisations in terms of lower levels of performance, lack of productivity, reduced staff engagement, and even increases in staff absences.

This year’s theme of loneliness is therefore very welcome and flags the importance for employers to try and ensure their employees can enjoy processes to hopefully help any negative feels and avoid feeling ‘alone’.

6 astute tips to avoid loneliness at work: –

1/ Training and open Management Styles

Companies and employers are helpless to try and alleviate loneliness in their workforce if they don’t have open channels of communication and don’t have the ear of their line managers, team leaders and staff. Companies should try wherever possible to designate a representative to be responsible for mental health and wellbeing who can be in regular contact with all line managers so that any issues can be flagged from the off, and the necessary support provided.

2/ Allow your company culture to permit staff to reach for help.

For so many years the mantra of businesses and employers has been to gloss over worker hardships and just tell their staff to ‘man up’. No longer is this acceptable for the majority of work places or their staff. Infact, the employers that encourage honesty and openness around their teams for individuals to say they need help without ridicule or derision, are the very same employers who will benefit from a loyal and higher performing employees!

To encourage open communication, implement employee satisfaction surveys with questions directly addressing how they are feeling in themselves. By offering their employees an ‘ear’ and by genuinely caring about their teams individual wellbeing, this can inform management strategies to help create better activities to address loneliness and other feelings or issues of anxiety or mental health problems. Alternatively you could use regular 1:1’s as a way of directly asking your staff about any worries they have and to encourage honesty and openness to express their thoughts.

3/ Lets talk! Have great communication channels in your team!

Increased staff engagement and open communication with your employees will improve all your team’s ability to feel connected to their colleagues, their jobs and their employer. Better lines of openness can go a long way in alleviating loneliness.

Companies who make sure that their processes are clearly communicated, will allow workers to feel much more confident about asking for support and help when they need it. It is really important to ensure that EVERYONE in the business is onside too. A toxic situation can be created when at grass roots everyone is feeling connected and able to reach out but the ‘boss’ or ‘senior manager/ director’ is unapproachable and always unavailable!

An example for our team at Astute is the way our owners Sarah and Mary, are always available to have a quick informal chat in private if there is an issue of concern or a personal problem that has arisen.

4/ Reward collaboration!

Having a culture that naturally rewards collaboration, across the business for everything from training to everyday work practices and initiatives, means that the likelihood of loneliness being experienced will be vastly reduced. By feeling more involved, listened to and supported, employees will individually have a much stronger sense of ‘belonging’ to their company which creates the opposite environment for loneliness to thrive. Stronger peer groups and inter-company / inter-department relations will also help to create a much more positive culture and again help banish loneliness.

As an example – for our team we have an employee of the month award. This can be given to anyone in our team and can be awarded to someone who has collaborated and helped their colleagues as well as for special achievements, not just for pure financial/ business performance. This enables the whole team to feel part of the challenge rather than just reserved for our top performers.

We also have our ‘Reward Board’ where everyone from our office manager to anyone else can win a range of prizes including half-day extra annual leave just by achieving non-sales activities that still benefit the business. This engages everyone, makes everyone feel valued and actually creates a fair bit of laughter, fun and banter.

5/ Avoid creating too much pressure!

This is a biggie. Many employees can feel disenfranchised, anxious and lonely if they are placed under undue stress. This is not the same as the pressure that they can individually place upon themselves either! Instead, bosses can often send the wrong signals that only x,y,z will do in terms of sales and production targets – which may actually be more geared / achievable by only the most experienced employees, rather than everyone being able to hit the same targets.

In more niche businesses, individuals can put too much pressure on themselves to perform – much more pressure in fact than their bosses can create! This can cause huge problems unless regular 1:1’s happen. A 1:1 is a great opportunity for employer and employee to directly address any pressures they are feeling that week. For the employer to ask this on a regular basis within a neutral, regular meeting will allow any concerns on this to rise up and be addressed, without the employee suffering in silence and more than likely feeling very lonely too.

At Astute, all of our team have regular 1:1’s to allow them to individually air any issues they may have as well as sharing great ideas and better ways of working that can benefit the whole team! Everyone is important to us.

6/ Use outside professional experts!

Most SMEs have under 15 staff, so it can be hard to have an in-house expert to cover all of this on top of their day-to-day job! So, it’s a great idea for any internal representative to be able to have access to an external professional who they can reach out to for trained guidance and involvement if necessary. MHPP is one such organisation that is free and specifically created to provide this free external support to all businesses.

We hope the above has been useful.

If you would like to read more about Mental Awareness Week, with useful links and more information head to our article HERE .

Good Recruiters are like swans. Clients and candidates should experience a smooth, calm recruitment process, and not see the way our legs are kicking madly under the water! Clients do need to realise that there is a lot of work that proper professional recruiters do behind the scenes though!

Good Recruiters are like swans. Clients and candidates should experience a smooth, calm recruitment process, and not see the way our legs are kicking madly under the water! Clients do need to realise that there is a lot of work that proper professional recruiters do behind the scenes though!

What was in Chancellor Rishi Sunak’s Autumn 2021 Budget statement for people and business? We take an Astute look at the key takeaways!

What was in Chancellor Rishi Sunak’s Autumn 2021 Budget statement for people and business? We take an Astute look at the key takeaways!

How to settle into a new job & prepare to return to the office… They aren’t that different!

How to settle into a new job & prepare to return to the office… They aren’t that different!